January is consistently one of the most challenging months for digital publishers, and for good reason. After Q4’s peak demand, the market resets quickly. Budgets pause, consumer spending slows, and CPMs fall across the open web. None of this is new, and none of it signals a problem with inventory quality or long-term performance.

Q1 is a recalibration period. The publishers who navigate it well focus on stability, flexibility, and preparation rather than short-term recovery.

Why CPMs Decline in January

Several structural factors converge at the start of the year:

Advertising budgets are still coming online

January is a planning and negotiation month. Many advertisers enter the year without fully activated budgets, which reduces immediate demand, particularly in open web programmatic channels.

Consumer spending slows after the holidays

Post-holiday pullback impacts advertiser urgency across retail, travel, and brand categories. Spend tends to return gradually as performance benchmarks reset.

Reduced bid density impacts CPMs

With fewer active campaigns competing in auctions, CPMs commonly decline 25–35% compared to Q4 levels. This reflects lighter demand, not diminished inventory value.

Q1: Recalibration, Not Reset

Early-year softness doesn’t require sweeping changes.

Q1 rewards discipline and measured decision-making. The priority isn’t to chase CPMs or lock in aggressive adjustments; it’s to stay close to performance signals, maintain flexibility, and avoid changes that create unnecessary long-term downside.

Where publishers tend to run into trouble is with reactionary moves, such as:

- Carrying over aggressive Q4 floors into a low-demand environment

- Pausing optimization until demand improves

- Avoiding testing because performance feels volatile

The strongest Q1 outcomes come from staying engaged, not standing still.

Floor Price Management: Balance Matters

Floor pricing plays a critical role during periods of lighter demand.

The goal in Q1 isn’t to permanently lower expectations. It’s to:

- Preserve healthy fill

- Maintain bid competition

- Avoid artificial revenue loss caused by misaligned floors

Temporary, data-driven floor adjustments can help protect total revenue while demand is softer. As advertiser budgets activate later in the quarter, floors can be recalibrated to reflect stronger competition.

Why January Is a Strategic Testing Window

Lower demand reduces risk and that creates opportunity. Q1 is one of the most effective times of the year to test monetization improvements that would be harder to evaluate during peak periods. This includes:

- New ad units and layouts

- Video placements

- Dynamic Ad Insertion (DAI)

- Docked or sidebar ad units

At Adapex, publishers who have implemented Dynamic Ads have seen 15–23% incremental revenue uplift, helping offset seasonal softness while strengthening long-term performance.

Q1 Defense Checklist for Publishers

Demand & Pricing

- Monitor bid density and win rates weekly

- Validate floors against current demand conditions

- Avoid static Q4 floor carryover

Testing & Optimization

- A/B test new placements and layouts

- Evaluate video where it aligns with user experience

- Test Dynamic Ad Insertion

- Experiment with docked or sidebar units

Performance Monitoring

- Focus on RPM and total revenue, not CPM alone

- Watch fill rate trends alongside CPM shifts

- Identify pages and units most sensitive to demand changes

Foundation Work

- Clean up underperforming placements

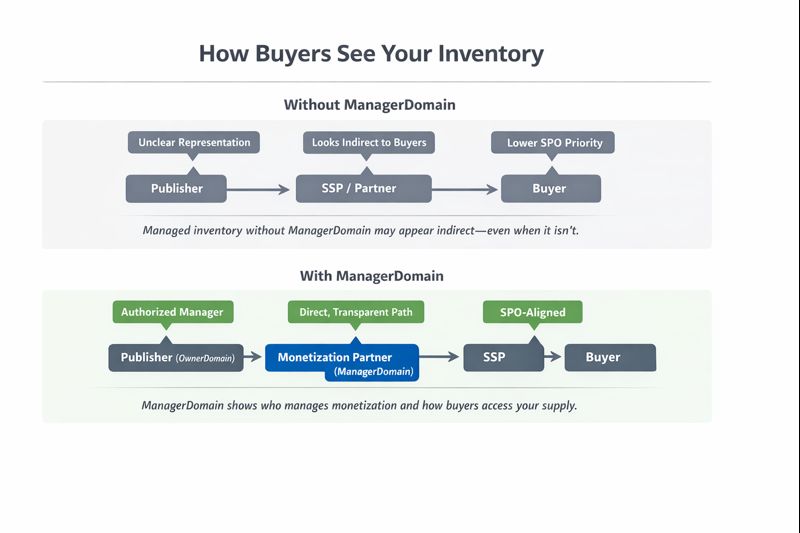

- Validate ads.txt and supply paths

- Prepare setups for Q2 and Q4 scale

The Bottom Line

January CPM declines are expected. Q1 softness is structural. The publishers who perform best don’t wait for demand to correct everything, they use this period to protect revenue, fine-tune monetization, and prepare for what comes next.

Q1 is defense season. Play it well, and the rest of the year benefits. Download the Q1 checklist here.